The Union Cabinet has approved the 8th Pay Commission, which will provide recommendations for changes to central government employees’ salaries and pensions. These changes are expected to be put into effect the following year. After the pay commission presents its recommendations to the center, the government will make a decision. The current pay structure for central employees is based on the 7th Pay Commission’s recommendations, which were implemented in 2016. The ‘fitment factor’, a multiplier applied to the present base pay, will henceforth determine the compensation revisions.

The 8th Pay Commission is a topic that has been the subject of discussions in India, particularly among government employees, as it impacts their salaries and benefits. While there is no official confirmation of its formation or exact details, I can provide information based on the trends and expectations surrounding the potential 8th Pay Commission.

Eighth Pay Commission

The 8th Pay Commission is expected to be the next pay revision body set up by the Indian government to review and recommend salary structures, allowances, and pension benefits for central government employees and pensioners. Pay Commissions are usually established every 10 years, and the 7th Pay Commission was implemented in 2016.

Key Points About the Eighth Pay Commission:

- Expected Formation – If the trend continues, the 8th Pay Commission could be set up around 2024-25, with recommendations likely to be implemented around 2026.

- Purpose – It will revise salaries, pensions, and allowances of Central Government employees, Armed Forces personnel, and pensioners.

- Expected Salary Hike – Speculations suggest a possible increase in the minimum basic salary from ₹18,000 to ₹26,000 and adjustments in the fitment factor (which affects salary hikes).

- Impact on State Employees – Many state governments adopt Pay Commission recommendations with modifications, so state government employees may also benefit.

Eighth Pay Commission Fitment Factor: What Is It?

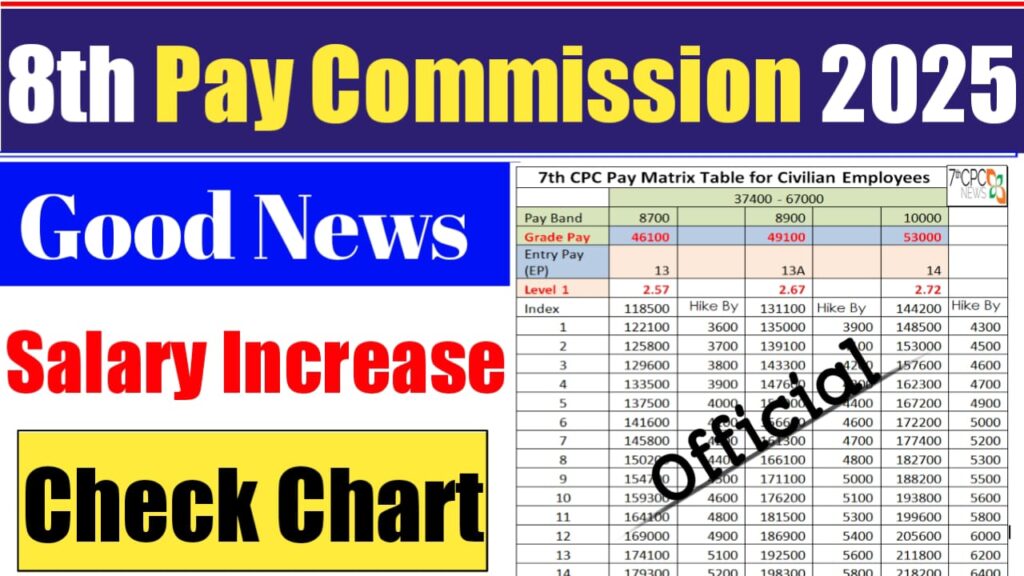

One important metric that determines how much the salaries should be changed in accordance with the pay panel’s recommendations is the fitment factor, which functions as a multiplication coefficient. Level 1 salaries were raised from Rs 7,000 (under the 6th Pay Commission) to Rs 18,000 in 2016, according to the 7th Pay Commission’s fitment factor of 2.57. However, this was not the employees’ take-home pay. Under the 7th Pay Commission, the total income was Rs 36,020 when, in addition to other benefits, dearness allowance (DA), housing rent allowance (HRA), and transport allowance were added to the Rs 18,000 basic pay.

According to reports, the basic wage in Level 1 might increase from Rs 18,000 to Rs 51,480 if the fitment factor increases to 2.86. Employee pay and pensions will therefore be revised at all ten levels.

Current Status:

- 7th Pay Commission: The most recent pay commission in India, the 7th Pay Commission, was implemented in 2016. It recommended a 14% increase in the basic pay for central government employees, along with various allowances and pension revisions. This pay commission was expected to stay in effect for 10 years, i.e., until 2026.

- 8th Pay Commission: There has been growing demand from employees and their unions for the formation of the 8th Pay Commission due to rising inflation, economic changes, and the increasing cost of living. Some expect it to be implemented after the 7th Pay Commission’s term ends in 2026, while others hope the government might act earlier, especially as inflation continues to affect workers’ purchasing power.

Key Aspects Likely to Be Covered by the 8th Pay Commission:

- Basic Pay Revision:

- Like all previous Pay Commissions, the 8th Pay Commission would likely propose a revision in the basic pay of government employees, which would be calculated according to current economic conditions, inflation rates, and government revenues.

- Dearness Allowance (DA):

- One of the primary demands of employees will be the revision of DA, which compensates for inflation. If inflation remains high, the government might increase the DA to offset the increasing cost of living.

- Pension Revision:

- The 8th Pay Commission would also likely propose revisions to pension schemes for retirees, in line with the pay revisions.

- Allowances:

- The commission may review various allowances, including:

- House Rent Allowance (HRA)

- Travel Allowance (TA)

- Medical Allowance

- Risk Allowance (for employees working in hazardous conditions)

- HRA could see an increase if housing costs are rising in urban areas.

- The commission may review various allowances, including:

- Grade Pay and Pay Matrix:

- The pay matrix introduced by the 7th Pay Commission could be adjusted or revised in the 8th Pay Commission to keep pace with inflation and changes in the responsibilities of government employees.

- Minimum Pay:

- There have been calls for the minimum pay to be revised upwards. In the 7th Pay Commission, the minimum basic pay was set at ₹18,000/month. There is an expectation that this could be increased in the 8th Pay Commission.

- Promotion and Career Advancement:

- The 8th Pay Commission could also look at revising the criteria for promotion and career progression for employees, especially for those in lower pay bands who may feel stagnant in their careers.

- Gratuity and Other Retirement Benefits:

- Government employees are also keen on better retirement benefits. The 8th Pay Commission could propose increases in gratuity and other retirement funds to make up for gaps in post-retirement income.

Potential Timeline:

- The 8th Pay Commission is most likely to be set up around 2026, as the 7th Pay Commission recommendations are valid until then.

- However, depending on political factors, there could be a push for it to be set up earlier, especially in response to pressures from trade unions or significant changes in the economy.

Speculation on Salary Hike:

- Some reports suggest that the 8th Pay Commission could offer a 20-25% salary increase to address inflation, but this is speculative and would depend on the economic conditions at the time of its formation.

Conclusion:

At this point, the 8th Pay Commission remains a future expectation, with no official details released yet. Government employees and trade unions continue to advocate for higher pay and better benefits, which could be addressed by this upcoming commission. To get official and up-to-date details, it’s best to monitor government announcements in the coming years, especially as 2026 approaches.

FAQs based on the Eighth Pay Commission

1. What is the 8th Pay Commission?

The 8th Pay Commission is a committee established by the Indian government to review and recommend changes to the salary structures, allowances, and pension benefits of central government employees and pensioners. Its primary goal is to ensure that compensation remains fair and aligned with current economic conditions and inflation rates.

2. When will the 8th Pay Commission be implemented?

The 8th Pay Commission is expected to be implemented on January 1, 2026. This follows the traditional ten-year interval between pay commissions.

3. How much of a salary hike can central government employees expect under the 8th Pay Commission?

While exact figures will be determined upon the commission’s recommendations, experts anticipate a salary increase ranging from 20% to 35%. For instance, with a 20% hike, the minimum basic pay could rise from ₹18,000 to ₹21,600.

4. What is the proposed fitment factor for the 8th Pay Commission?

The fitment factor is a multiplier applied to the current basic pay to arrive at the revised pay. For the 8th Pay Commission, it is expected to be around 2.28, potentially increasing the minimum basic pay from ₹18,000 to approximately ₹41,000.

5. How will pensions be affected by the 8th Pay Commission?

Pensioners are likely to see an increase in their pension amounts corresponding to the revisions in pay scales. For example, with a fitment factor of 2.28, the minimum pension could increase from ₹9,000 to around ₹20,500.

6. Who will benefit from the 8th Pay Commission?

The recommendations of the 8th Pay Commission are expected to benefit approximately 50 lakh central government employees, including defense personnel, and around 65 lakh pensioners.

7. Will allowances like Dearness Allowance (DA) and House Rent Allowance (HRA) be revised?

Yes, allowances such as DA and HRA are typically revised in line with changes to basic pay. For instance, the DA is anticipated to rise to 70% by January 2026, which will be factored into the overall salary calculation.

8. How does the 8th Pay Commission differ from the 7th Pay Commission?

The 7th Pay Commission, implemented in 2016, introduced a simplified pay matrix and set the minimum basic pay at ₹18,000 with a fitment factor of 2.57. The 8th Pay Commission is expected to propose a higher fitment factor and a significant increase in minimum pay, potentially up to ₹51,480, representing a 186% increase.

9. How can employees calculate their expected salary under the 8th Pay Commission?

Employees can use online salary calculators designed for the 8th Pay Commission. These tools allow users to input their current pay details and apply the expected fitment factor to estimate their revised salary.

10. What factors influence the recommendations of the Pay Commission?

The Pay Commission considers various factors, including current economic conditions, inflation rates, and the cost of living, to ensure that government compensation structures remain fair and competitive.